INVESTORS

FundNV Investment Criteria

FundNV invests in exceptional founders who demonstrate momentum and proof.

- Proof: Founders and companies must meet or exceed multi-month goals consistently

- Investment Vehicles: SAFE and priced, preferred round lead investor

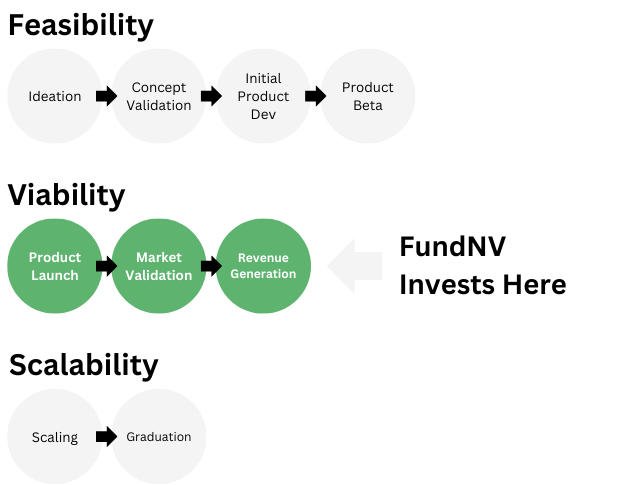

- How FundNV Invests into Companies:

- $100k investment + SPV syndication + State of Nevada SSBCI Match

- Via SAFE or priced round, with a lead investor

- Deal Flow: Partnership with StartupNV provides the best startup deal flow in Nevada

- Minimum LP Investment into FundNV II: $10,000

FundNV does not NOT invest in:

- “Concept” Stage Ventures: Companies must have a product in beta or beyond

- Super Capital-Intensive Ventures: Our investment become less impactful in these cases

- Non-Affiliated Companies: Startups must go through the StartupNV accelerator program to be considered for investment

Consistently Robust Deal Pipeline

Through our affiliation with StartUpNV, FundNV sees the most consistent pipeline of scalable, early stage startup opportunities within the state of Nevada.

Evaluations / Investment

Directly Invested

Current Portfolio Value

Multiple on Invested Capital

** Q3 2017 thru May 1, 2024

Pitch Days + Q&A

FundNV runs regular “by invitation” pitch cycles each quarter with decisions made within two weeks. LPs are invited to pitches / Q&A – with recordings made available to all LPs.

We see ~250 companies for each investment we make. We average 5 investments per year.

Fund Details

Informational Only – Not a Solicitation to Invest

Fund Target

$2M

Fees

2% Management

20% Performance

Minimum Investment

$10,000

Investor Criteria

Federally Accredited or

Nevada Certified

FundNV is formed as a Nevada series LLC, open only to Nevada Certified Investors (Nevada residency is required) and federally accredited investors.

FundNV charges a 2% management fee and 20% carried interest, with administrative fees and profits shared with StartUpNV for general administration and pipeline management.

Minimum LP (FundNV II investor) investment is $10,000 for two fund units. Additional units are $5k each. Non-binding interest is expressed by registration.

- Legal signatures and funding happens once the fund reaches 33% committed.

- Investors will be asked to fund 50% of their committed amount on the first capital call.

- The balance of the investment commitment will be called when 50% of the initial funding amount is invested (estimated to be in late 2025).

Fund target is $2M, minimum is $1M and will close to additional investors when the fund target is committed in writing.

Investment Committee

Our Investment Committee consists of experienced founders and early-stage innovators, collectively possessing decades of expertise.

Kristin Tomasik

Investment Committee Member

Vicki Zhou

Investment Committee Member

Jeff Saling

Investment Committee Member

Learn More About Investing

Our philosophy is to put as much Nevada based capital to work in Nevada based startups.

If you want to learn more about Nevada Certified Investors, how FundNV works or are interested in Investing, please reach out below.